Cascabel: Emerges a new world-class mining deposit

For more details visit MINERGÍA digital version: https://issuu.com/minergiaec/docs/minergia_10/34

During 2016, the Cascabel mining project occupied headlines of the international media thanks, on the one hand, to the progress of it and on the other hand to the interest of large mining investors. It is in an advanced exploration phase and several of the results obtained since 2012 qualify Cascabel as a large world class copper-gold deposit.

The project was acquired in 2011 by the Canadian junior Cornerstone. In 2012 Australia-based company SolGold, based in Brisbane, acquired 85% interest of Cascabel. SolGold, through its Ecuadorian subsidiary Exploraciones Novomining S.A. (ENSA), manages what could become one of the most important copper and gold producing mines in Latin America.

Cascabel is located 180 kilometers north of Quito, in the province of Imbabura. The concession covers an area of 5,000 hectares.

The project counts with 171 Ecuadorians and four expat geologists. It is located approximately 1,800 meters above sea level.

On September 10, 2016, the company reported in a statement that «all the information obtained presents a high possibility of discovering a deposit of gold and copper that is unparalleled -in size and quality- with other mining projects in Ecuador».

According to Nick Mather, SolGold’s Executive Director, at Alpala, “we have completed 23,700m of drilling for 18 drill holes of which 16 have hit the Alpala deposit and 6 of which (Holes 5, 9, 12, 15R2, 16 and 17) delivered world class intersections – consisting of over 1km of continuous mineralization grading over 1% Copper Equivalent”.

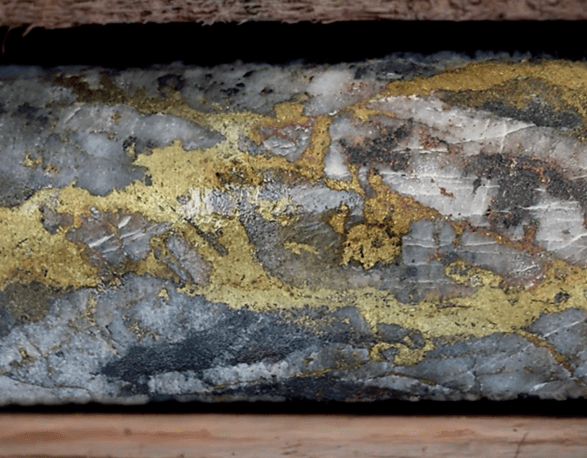

Drill hole CSD-14-009 for example, returned one of the best results in the history of mineral exploration, with 1088m grading 0.66% copper and 0.89 g/t gold for 1.48% Copper Equivalent.

“Alpala alone is emerging as a tier 1 copper project with higher than average grades in both copper and gold, and the project will enjoy the support of a coterie of pretty sisters in the surrounding targets”, he said.

Mather, who brings more than 30 years experience in geology and project management, sees a great deal more potential to unlock at Cascabel thanks to the ascent of large highly oxidized magma bodies in pre-historic (Eocene) times, that facilitated the distillation and enrichment of iron, copper and gold bearing fluids into the porphyry systems at Alpala.

During the first four years of operations in Ecuador, SolGold has invested US$ 40 million mainly on 50km² of airborne magnetics advanced studies, 30kms² of Orion 3D IP Surveying, detailed soil gridding, rock-chip and rock-saw channel sampling, geological and structural mapping, 3D modelling and interpretation.

The company has just started a planned two-year 95,000m drilling program with Hubbard Drilling and Major Drilling, to expand Alpala and drill test targets including Alpala South East, Hematite Hill, Trivino, Moran, Aguinaga and Tandayama-America.

Funding to explore

In October, 2016, SolGold reached two important agreements to finance the advance of Cascabel. The first one was with Australia’s Newcrest Mining, which invested US$ 22.86 million to acquire 10% interest of SolGold. On the other hand, Maxit group received 4.43% of the company in exchange for an investment of US$ 10.1 million.

With almost US$ 44 million in the bank, which will go mainly to advance with the deposit exploration, it was clear the confidence that SolGold and Ecuador have gained nowadays internationally.

Another clear example of the good momentum of mining in the country is the purchase intention that the world’s largest miner presented for Cascabel. It was BHP Billiton, which offered US$ 30 million, or 22 cents a share, for a 10% stake in SolGold. BHP’s offer included an additional proposal of US$ 275 million for the acquisition of a 75% stake in ENSA. This offer was rejected by SolGold’s Board of Directors.

Similarities

The geophysical modelling is revealing stunning similarities along the Alpala-Moran trend with the giant Hugo Dummet orebody at Oyu Tolgoi in Mongloia, whilst the Alpala Deposit by itself has near identical geology, mineralisation style and geometry as Newcrest’s Golpu deposit in PNG. The surrounding targets at Aguinaga, for example, are reminiscent of some of the great porphyry clusters in Chile, and the project has been compared by geologists of the world’s largest mining firms, as the great Chuquicamata cluster.

Who is SolGold

SolGold was born in the South-West Pacific on Guadalcanal in the Solomon Islands. The collision of the huge Pacific and Australian tectonic plates gave a fragmented tectonic regime which produced only partially fertile melts and dominantly low-grade porphyry systems. Back then we operated within a primitive regulatory environment and an aggressive and dynamic physical environment on very steep terrain dominated by rainfall measured in metres and the risk of big landslides and flash floods.

According to Jason Ward, General Manager of SolGold in Ecuador, “we took that knowledge and experience to the gold rich northern section of the worlds most endowed copper theatre, the Andean Copper Belt and honed in on Ecuador as our target. We wanted a tier 1 discovery – one that transcends metal price cycles, is always profitable and lives for many generations. The Andean Copper belt has a habit of delivering that sort of asset (eg. La Escondida, Chuquicamata, El Teniente and others)”.

INTERVIEW

Jason Ward, General Manager of SolGold in Ecuador

“We are focused on developing a mine. “

What’s the relevance for Ecuador of having big players such as Newcrest supporting Cascabel?

Firstly, that Newcrest and a number of other large mining companies are interested in Ecuador is not surprising because of the geological prospectivity and the very under explored status of Ecuador. However we believe that the exploration for and discovery of these projects is best done by junior companies who are able to move more quickly and in many cases expend the money more effectively. Newcrest has endorsed the SolGold management and exploration team and we are well funded and will be more so as we progress. So it’s not big companies that will make Ecuador a large copper producer, its smart efficient companies like SolGold. That’s why Newcrest backed us.

The world’s biggest miner, BHP, made an offer for Cascabel in 2016 and SolGold rejected it. Do you expect them back or any other investor making an offer for the project in the near future?

It is very important that people understand exactly what BHP offered. SolGold already had a strong proposal by Newcrest to invest in the company which was on much better terms for us than the BHP proposal. The BHP proposal was not an offer that was in the best interests of SolGold shareholders. The current share price is a lot higher than what BHP offered and the project earn in proposal was highly conditional and uncertain. We are focused on SolGold developing a mine.

How are the relations between SolGold and the communities?

Our community relations are excellent. This another advantage of SolGold over many other large companies. We put a lot of effort into the community and environment and have developed a very strong base. We prefer to employ Ecuadoreans and support local businesses and put a lot more effort into this than do many major companies. Our management team is very experienced in CSR programs and we take it very importantly. We want the local Ecuadoreans to have a sense of pride and involvement and we strive to encourage it.

How many people are working in the company?

At the moment, in Ecuador, we employ a total of 171 Ecuadorians and only 4 expatriate geologists, who fly in and out of Australia. One of the great advantages of operating in Ecuador is the high quality of the workforce. As well as this direct employment, we support many more families indirectly through supporting local businesses and cooperatives. These numbers will grow significantly as the project advances. Apart from building a mine, we want to leave a legacy of education and training for as many Ecuadoreans as we can.

What’s the forward plan now?

Solgold now has a war chest of US$ 44 million with which to expand Alpala and drill test the other copper-gold targets, particularly Alpala South East, Hematite Hill, Trivinio, Moran, Aguinaga and Tandayama-America. We’ve got 95,000 metres of drilling planned over the next two years by using directional drilling and ramping up to 10 rigs.

When does the Company plan to put out the first Cascabel’s resource statement?

We will define the limits of the Alpala system first. It’s very large and each new drill hole is expanding the size of the system. We are putting more drilling rigs onto it as we progress. There will be two drilling rigs arriving in the first quarter of 2017. So we expect to announce our maiden resource in the latter part of 2017. We need to see just how big this system is before we start doing infill drilling to come up with a resource. Its over 1.5 kms long at surface and so far on average 300 m wide and over 1.8 kms in vertical extent. But it could get much bigger. That’s why we have to drill more. There’s no point announcing a resource too early.

How long it would take to convert Cascabel into a mine?

It depends on the size of the mine. A smaller higher grade mine may take three years. Realistically we are looking at a large operation and it would take 5 years or more but it would be world class and tier 1.